Thursday 24 February 2000

|

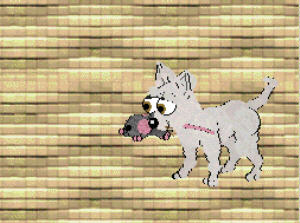

Pic of the day: Typical private investor. Not exactly getting the lion's share. (Screenshot from Petz II.) Bulls, bears and small dogs I am not a rich man, by Norwegian standards. I don't earn much, compared to the average person my age, including women; and I am not a saver (savior?) of money. Still, by chance, I have a few shares. Or rather parts in some stock market fund. Supposedly they should help their customers buy the right shares, but they rarely outperform - or even equal - the average stock index. Heh. Anyway, I just want you to know where I stand, because I guess I am about to say something controversial. Namely that it would be a good thing if the stock market deflated. A lot, though not necessarily very fast. *** The professional economist reading this must forgive me, for I shall now shortly describe the reality of shares and the stock market. This beast is namely not what it seems to the casual newspaper reader. The stockmarket is not a lottery. It just plays one on TV. The professionals know a few things that the eager newcomer does not. History shows us that the late comers, the non economists, tend to be the ones who get burned. So let us get the facts right. Shares are simply parts of a corporation. The shareholder own a small part of the company. But unlike personal companies, the owners do not stand responsible for the debt of the company, only for what they have invested in shares. If the company defaults on its debts, the share capital will be forcibly spent on repayment, and the owners will lose their investment, but no more. This makes shares an attractive investment compared to private ownership. If the company shows a profit (or has free capital from past profits) it will normally pay a dividend to its owners. Ideally the dividend should be higher than the interest rate of a loan, as the shareholders take a higher risk. (In case of failure, the stock capital will be used to repay loans, remember.) By its nature, then, the stock market is a place for investors. Not for gamblers. The idea is that you risk your capital, and in return you get a yearly compensation in the form of a dividend. *** Now the return on your investment depends of course on how much you paid. If a share sells for $100 and gives a dividend of $10, it is quite a good investment. People will ask to buy this share for more than its nominal worth, since they will still have a handsome return on their investment, above what they could get from a bank. But there are limits to this. If the price reaches $300, for instance, the return is suddenly only 3.33% even with the same dividend. Because the dividend is payed on each share as originally issued, with no regard to what you personally paid for it. *** Sometimes a company will forgo paying dividend, and instead invest the profit. Perhaps within the company, in better equipment or in attracting a more competent workforce. Or they may invest in other companies that they deem more profitable for the future than their original activity. If this investment is successful, the company will be stronger, able to create a higher profit in the future. It is the expectation of higher profits that drives up the price of such shares. At some times, including the last few years, there has been a lot of investment and hopes of increased profit. This has put an upward pressure on the share prices. At the same time, alternative investment (typically credit) has seen reasonably low interest rates, meaning that shares have had little competition. At some point, however, the growth in share prices take on its own life. People look to the stock market, and they see that prices have increased. They see that some people have bought cheap and sold later with a great profit. The idea of a large profit with little work appeals to a lot of people, and they arrive at the stock market to buy shares based on the hope of selling with a profit, not a desire to remain owners and harvest a yearly dividend. This is what we call a "bubble" in the market. The same thing happens occasionally to property such as houses. But as shares are very abstract to many people, the stock market is particularly prone to these bubbles. The bubble ruins the market for those who actually come there to invest. The serious people. Some of them stay and try to navigate their way, buying where the price is likely to go up. Certainly even professionals like a bit of excitement. But the fact remains that the market is damaged, and at some point the professionals start to draw out. The "bulls" and "bears" of the market disappear, leaving the floor to a motley crew of chihuahuas and dwarf poodles running around in a yapping frenzy. And then someone discovers that the game is over. Until the market returns to its original function, as a marketplace for long-term investment, you should make all your trading in shares with the conscious knowledge that this is money you could lose. And unless you have in depth knowledge of the companies you trade in, you should be consciously aware that you are a poodle among bulls and bears. Happy hunting! |

Mild day, snow melting. |

Yesterday <-- This month --> Tomorrow?

One year ago