Perhaps people will have to walk and bike more, the way Japanese already do. It does not seem to hurt them.

You may have heard the phrase “peak oil” recently. This simply means that the world’s production of oil has reached its peak, or highest level. It does NOT mean that suddenly one morning we will wake up and there is no oil left. Quite the opposite, in a manner of speaking: Because peak oil means that oil has become more expensive, it now is commercially viable to extract oil in places that were not worth the trouble before. America has increased its production quite a bit over the last five years or so thanks to this. (And added hundreds of thousands of American jobs in the process. So it is good for something!)

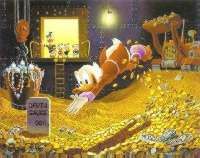

So what we are facing is not a sudden end to oil, but a gradual increase in prices as the difference between demand and supply grow wider and wider. When something is very rare but useful, like gold or diamonds, the price is very high. Oil is gradually moving in that direction. It will not forever be plentiful enough to just burn for heating. It will be reserved for production of chemicals, plastics etc.

But it is not only oil that may have peaked. There are also several metals that are starting to become expensive. Again, this is not because we have mined all the ore in the world for that particular metal. It is just that the reserves are deep in the ground, or under the bottom of the sea, or in other places that are hard to get to. Not even all of the reserves are in such places, but the ones that are easy to get are no longer enough.

It does not help the prices that demand is going up. The world population is still growing, but more importantly, many developing countries are now actually developing. And they need many of the same things we need: Â Metal, glass, rubber, oil. After all, now that they are getting a bit of money, they want the kind of things we have, more or less.

Actually the newly developed countries won’t need as much resources as we did at the same level of development. For instance, we needed lots of copper for phone cables, but developing countries are largely skipping landlines and jumping straight to mobile phones. With these, and increasingly also smart phones and the Internet, the need for transport is also less than it was. Rather than having to travel to the next town to check whether there is cheap rice for sale, you can just call or check on the Net, and stay home if there isn’t. So a lot of time is saved, and transport of people is less necessary when everyone is connected.

Overall, though, more money means more activity of all kinds and needs more resources.

Some resources are almost endless, by the way. Glass is made mostly from sand, and we won’t run out of that until Sahara becomes Communist, as the joke goes. There is a huge reserve of high-quality sand, so we should be seeing plenty of affordable glass for the foreseeable future. Â (In so far as the future is ever foreseeable – we may be hit by an asteroid or fall into a black hole etc, but you know what I mean.) Likewise there is unlikely to be peak salt as long as the sea tastes like tears. Arguably we are also pretty far from peak sun, but there are a few problems there.

There are two basic ways of getting electricity from sunshine. One is to collect the heat of the sun with big mirrors and boil water to run a steam engine. This should continue to be feasible for a very long time. The other approach is solar panels, directly converting the sunlight into electricity. This is the cool approach, and these solar cells can be placed anywhere there is enough sunshine, even on your own property. Â This is particularly nifty if you live in warm areas where you need to use air conditioning to maintain a healthy temperature indoors. When the sun is baking, that is when you need electricity the most. With solar cells, you can get it right then and there, from the same sunshine that makes it too hot in the first place.

Unfortunately, solar cells need some rare earth elements. These are found naturally in small amounts in various ores, but the only large deposits in the world are all in China. That’s certainly nice for China. It looks like new technology may be able to replace some of those rare elements, but for now, local solar power depends on Chinese goodwill. (Or at least enlightened self-interest.)

When gas prices hit $10 per gallon (should not be so far off) you may want to be able to drive en electric car. These have become pretty good. They may not be able to run as far and as fast as gas cars, but they can break the speed limit and get you to daycare and work and back with no problem. And they are pretty cheap in use. They are becoming cheaper to make as well. But this may change. You see, the batteries again need some elements that are not plentiful. When you make a few thousand cars, this is not a concern. If you plan to make tens of millions of cars, or even hundreds of millions, and replace the batteries every couple years (even the best batteries are unable to hold a full charge after that long), you have a problem.

***

So, what does “peak everything” mean for you? Basically it means that a lot of things will become more expensive. This is not really inflation as we are used to thinking of it. The old type of inflation came from too fast growth and too much money sloshing around. The new price growth comes from a limited supply. This is not the same thing. Curing the old inflation was a matter of making sure there was less free money, for instance by raising interest rates. This will not miraculously cause more oil or copper or lithium to manifest on Earth.

There is a risk that central banks will just follow the old script and try to fight the New Inflation by raising interest rates and issuing less money, thus making the problem worse. So far the Federal Reserve at least has excluded energy prices from their inflation measure, and the Central Bank here in Norway does the same. But what will they do about products that need oil either to create (like plastics) or to grow (mechanized agriculture) or to transport (almost everything that is not made next door)? And what will they do about products that contain copper, silver, tin, antimony, bismuth or neodymium? When the cheap gas-powered cars become fairly useless and you have to buy a more expensive electric car, is it inflation?

It is hard to say whether governments and central banks will actually make things worse. Governments probably, if it is within their power, since governments represent the common people. You probably know a number of common people, so your wariness is quite natural.

But even in a best case scenario, barring divine or extraterrestrial intervention, we will see a period where a wide range of things become more scarce and expensive. If you are going on a long vacation this summer, enjoy it with all your might: There won’t be many more. From now on, we are on a course of gentle decline in the areas of transport and mass consumption.

On the bright side, electronic communication will probably continue to be cheap. So watch this space, or other spaces like it. There is a lot more to life than vacation in exotic places. In fact, some of us even LIVE in exotic places. And there are many sources of happiness that don’t depend on having lots of oil and copper.