Wednesday 28 February 2007

|

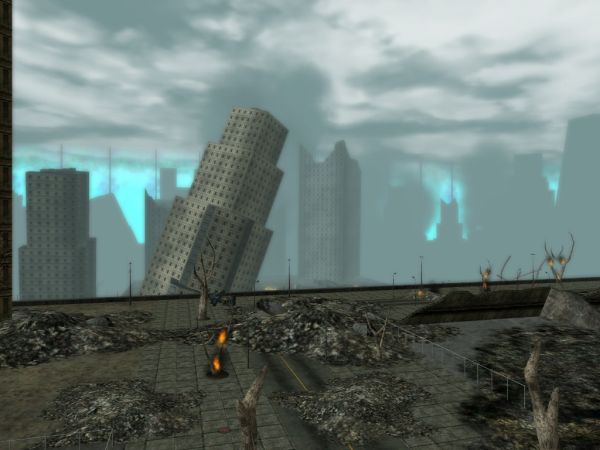

Pic of the day: Regular readers would guess just from the picture of ruin and destruction that I'm once again going to dwell on the American economy. Shock exchangeThey say it started in China, this time, the mild panic on the world's stock exchanges. In Shanghai, perhaps. But the people who were there say that it was the news from the USA that caused it. The truth is most likely that everyone had been nervous for some time. OK, not quite everyone: Not the amateurs who had just come into this exciting new venue of moneymaking. But anyone with more than half a week of formal economic education would realize that they were flying on a wing and a prayer, and no doubt as the wing began to sag the prayers became ever more fervent. Yesterday was not a happy day on the stock exchanges, and neither was today. It is not quite a panic, but people are more nervous than during the earlier corrections. As well they should be. The property market in the USA (and some other countries) has been ridiculously overvalued, but this tide has already turned. It just takes some time for the consequences to show up. In most modern economies, and not least in the USA, there are two fairly separate classes of lending for property. The ordinary mortgages are fairly cheap, but require you to finance part of the purchase yourself (or with the help of rich relatives, of course). These loans are called "prime" mortgages, in contrast to the "subprime" mortgages for customers who need to borrow more of the total price, and/or who have a less than stellar credit record. The subprime mortgages carry a higher interest rate, are typically for a shorter duration, and often have strange fees attached that make them even more expensive. Now bear in mind that these people start out with less money in the first place and frequently a lack of successful experience in handling money. This all goes well as long as the house prices rise like Manhattan elevators, as they did for the preceding years. After only a few years, the price of the house is so high, the owner can refinance to a prime mortgage. But when the house prices slide rather than rise, you can only dream of refinancing. On the contrary, with the high interest rates and fees, and with a too optimistic starting point, some of them start to lag on their payments. Actually that's quite a number of them by now, particularly those who had loans with adjustable rates. And so the credit companies that specialize in subprime lending are starting to feel the unfamiliar pull of gravity. In fact, some of the biggest may be on their way to dissolution. That is definitely going to cause a tremor. A market flush with credit for everyone has been the rule for so long, people have taken it for granted. Not anymore. ***Yeah, I know I've been harping on this chord for so long... well, even in Sahara if you tell every day that it will rain soon, you will sooner or later be right. If anything, the mystery is why it hasn't happened before. Regular readers, if any, will know that my predictions and reality started to diverge late in 2001. I predicted that the economic downturn that had begun would continue as a slow but unstoppable slide, a soft landing that would gradually unwind the mis-allocated resources from the Long Boom. Unemployment would rise to a level where people grew cautious and started saving instead of borrowing. Well, so much for that. We got a few scares, but mostly people have kept spending, and so has the government. (Still talking about the USA here, since it is for a while yet the most important country in the world, at least when it comes to economy.) What happened, as I have realized in retrospect, was that I underestimated the willingness of the Americans to borrow from the future to get short-term benefits. Both the government and the citizens have independently of each other borrowed like crazy. Normally one of the sides will hold back, and it is the government that is responsible for the balancing. But in this case, the nation as a whole has borrowed from abroad to an amazing degree – on average about 2 billion dollars a day! To put it cruelly, there is no longer a reason to worry that the USA will become a third world country in the future: It is already receiving more foreign aid than any other country ever has. Well, unless you know of some secret master plan to pay the money back. I certainly don't see any hints of that. Even though it is obvious that the United States cannot pay back all the money they are borrowing, each lender can still hope that exactly his loan will be paid back. And so long as that hope persists, the play can go on, much like the cartoon character who walks out from a cliff and does not fall until he looks down. But each such jitter and tremble in the stock markets is a chance to fall. If many enough people look down at the same time, the bottom will fall out of the market. Of course the United States as such will not default on its debts. Individuals will do, though, and it has already begun. As for the nation, it will be forced to devalue its currency, one way or another. As the dollar slides compared to other currencies, it becomes easier to pay debt in dollars. But of course this also means the creditor will get less back, since the dollars are less worth. Still better than getting nothing. The question is how far and how fast this goes. Ideally it ought to move very slowly, so that you barely notice it. People can get used to almost anything if it only happens slowly and over long time. Right now it is not happening slowly enough for my tastes, but it has only been two days. There will be more days, and they will have ups and downs, but overall there will be more downs and ups. Or that is what I hope. It is better than getting all the downs at once and fall like a stone. Or perhaps more appropriately, like a house built on sand. |

Yesterday <-- This month --> Tomorrow?